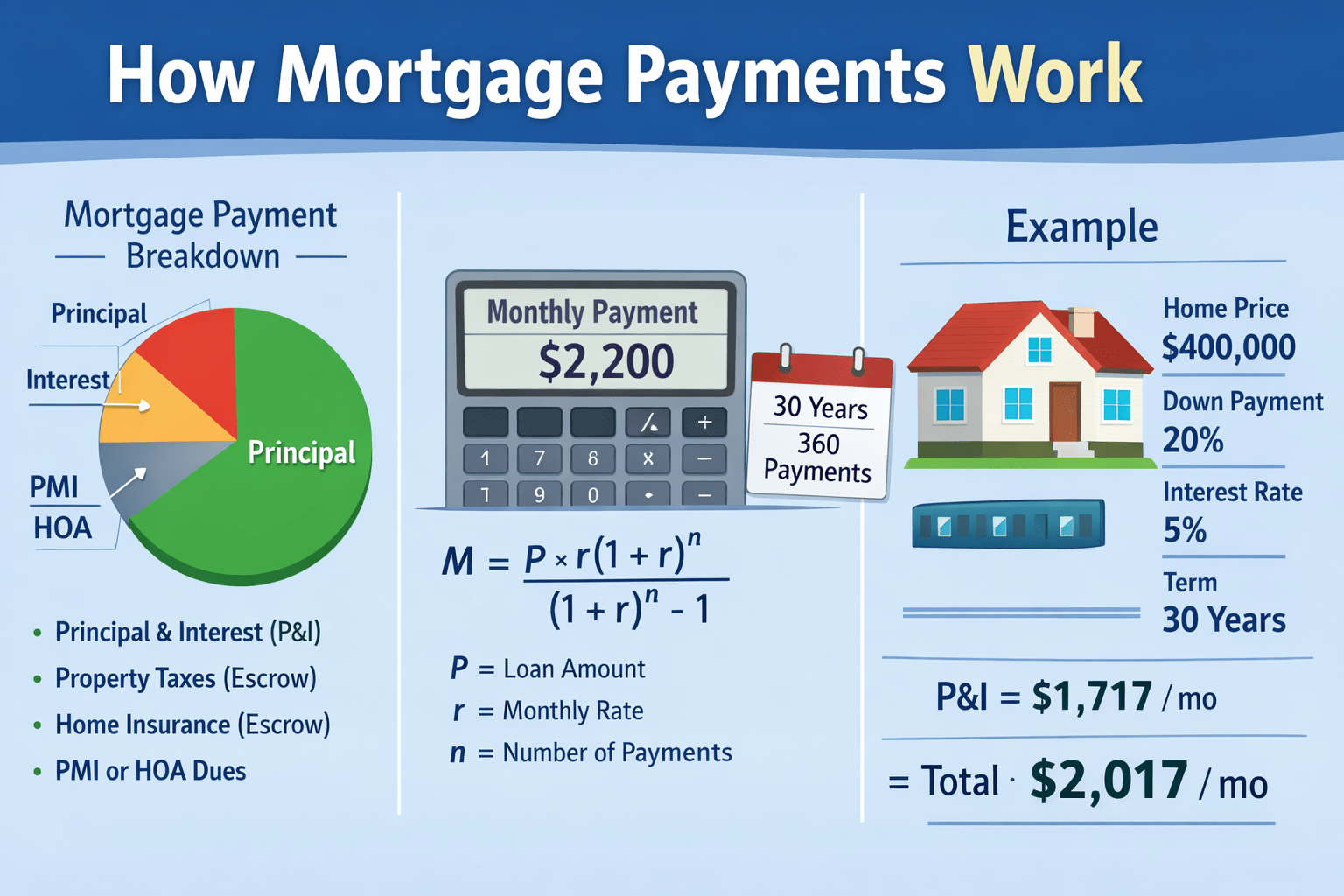

A mortgage payment is mainly principal and interest (P&I) set by an amortization formula that spreads a loan over a fixed number of monthly payments. Many borrowers also pay property taxes and homeowners’ insurance through escrow, plus possible PMI and HOA dues. The “all-in” amount is often called PITI.

This is educational content for learning and planning only, not financial, legal, or tax advice.

Key points

- P&I is determined by the loan amount, the monthly interest rate, and the total number of payments.

- Each payment splits into interest (based on the remaining balance) and principal (the rest).

- Your “total monthly payment” can include taxes, insurance, PMI, and HOA—those can change over time.

- Extra principal payments reduce total interest and can shorten the payoff time.

Definition

A mortgage payment is the periodic amount you pay to repay a home loan. For a standard fixed-rate mortgage, the lender sets a constant P&I payment that covers interest on the remaining balance and gradually reduces the principal to zero by the end of the term.

Many borrowers also pay monthly escrow for property taxes and homeowners’ insurance. Escrow affects what you send each month, but it does not reduce the loan balance.

Also called: amortizing payment, P&I payment, PITI payment (when taxes/insurance are included)

Why it matters

- Estimate affordability before you buy.

- Makes it easier to compare loan offers (rate, term, fees, PMI).

- Explains why early payments are “interest-heavy.”

- Helps you budget correctly by separating P&I from taxes/insurance/HOA.

- Helps you spot why a “fixed-rate” payment might still change (often escrow).

- Supports decisions on down payment size and PMI tradeoffs.

- Shows how extra payments change payoff time and interest cost.

- Improves refinance decisions by clarifying what changes (rate/term) vs what doesn’t.

- Helps you sanity-check lender worksheets and online calculators.

Mortgage Payments Key terms

| Term | Meaning | Units/Notes | Common mistakes |

|---|---|---|---|

| Principal | Amount borrowed (starting balance) | Currency | Confusing principal with down payment |

| Down payment | Cash paid upfront to reduce borrowing | Currency or % | Forgetting closing costs are separate |

| Interest rate (note rate) | Rate used to compute interest on balance | %/year → convert to monthly | Using annual rate as monthly |

| Monthly rate (r) | Periodic rate used each payment | r = i/12 (monthly) | Mixing APR and note rate |

| Term | Time to repay | Years or months | Mixing 30 years with 30 payments |

| Amortization | Balance declines over time via payments | Schedule/table | Assuming principal is constant monthly |

| P&I | Principal + interest payment | Currency/month | Assuming it includes taxes/insurance |

| Escrow | Monthly collection for taxes/insurance | Currency/month | Thinking escrow reduces the loan |

| PITI | P&I + taxes + insurance | Currency/month | Forgetting PMI/HOA may be extra |

| PMI | Mortgage insurance on some loans | Currency/month | Assuming it lasts forever |

| APR | Rate including certain fees | %/year | Using APR in payment formula without intent |

Mortgage Payments Formulas and rules

1) Fixed-rate monthly P&I payment (fully amortizing)

Let:

- P = loan principal (amount borrowed)

- i = annual interest rate (decimal, e.g., 6.25% = 0.0625)

- r = monthly rate = i / 12

- n = total number of monthly payments = years × 12

- M = monthly principal-and-interest payment (P&I)

Formula:

M = P * [ r * (1 + r)^n ] / [ (1 + r)^n – 1 ]

Special case (0% interest):

If r = 0, then M = P / n

2) Split each monthly payment into interest and principal

For month t:

Interestₜ = Balance₍ₜ₋₁₎ * r

Principalₜ = M − Interestₜ

Balanceₜ = Balance₍ₜ₋₁₎ − Principalₜ

3) “All-in” monthly outflow (common budgeting view)

Total monthly due = P&I + taxes (escrow) + insurance (escrow) + PMI (if any) + HOA (if any)

Assumptions and edge cases

- This is for fixed-rate, fully amortizing loans (constant P&I; balance reaches 0 at month n).

- Monthly payments with monthly rate r = i/12 (payment frequency must match).

- Escrow is separate from amortization; taxes/insurance can change even when P&I is fixed.

- Rounding to cents creates small differences across schedules and calculators.

- Extra principal payments change the balance faster and can shorten the term.

- If r = 0 (0% interest), use the special case M = P/n.

- ARMs recalculate after rate resets; treat the loan in segments.

- Interest-only or negative amortization loans do not follow the standard formula.

- Escrow shortages/surpluses can change total due even if P&I stays the same.

- PMI may drop off after equity thresholds, changing the total payment.

Mortgage Payments Step-by-step process

- Start with the purchase price and down payment.

- Compute loan principal: P = price − down payment (plus rolled-in costs, if any).

- Identify payment structure:

- If fixed-rate, fully amortizing → use the standard payment formula.

- If ARM/interest-only → payments are calculated differently (piecewise rules).

- Convert annual rate to monthly rate: r = i / 12.

- Convert term to number of payments: n = years × 12.

- Compute monthly P&I: M using the amortization formula.

- For the first month, compute interest: Interest_1 = P × r.

- Compute principal paid: Principal_1 = M − Interest_1.

- Update balance: Balance_1 = P − Principal_1.

- Repeat monthly: interest falls as balance falls; principal share rises over time.

- If escrow applies, add monthly taxes and insurance to your budget.

- If PMI/HOA applies, add them too; re-check when PMI ends or HOA changes.

Mortgage Payments Examples

Example 1 (typical): fixed-rate with escrow

Inputs

- Home price = 450,000

- Down payment = 20% = 90,000

- Loan principal P = 450,000 − 90,000 = 360,000

- Annual interest rate i = 6.25% = 0.0625

- Term = 30 years → n = 30 × 12 = 360

- Taxes = 0.9% of price/year = 0.009 × 450,000 = 4,050/year

- Insurance = 1,200/year

Steps

- Monthly rate r = 0.0625 / 12 = 0.0052083333

- Monthly P&I payment:

- M = 360,000 * [ r(1+r)^360 ] / [ (1+r)^360 − 1 ]

- M ≈ 2,216.58

- Monthly escrow:

- Taxes = 4,050 / 12 = 337.50

- Insurance = 1,200 / 12 = 100.00

- Total monthly outflow (budget view):

- 2,216.58 + 337.50 + 100.00 = 2,654.08

Result

- P&I ≈ 2,216.58/month

- Total (with escrow) ≈ 2,654.08/month

Sanity check

- First-month interest ≈ 360,000 × 0.0625 / 12 = 1,875.00

- First-month principal ≈ 2,216.58 − 1,875.00 = 341.58

- New balance ≈ 360,000 − 341.58 = 359,658.42

Example 2 (edge case): adding extra principal monthly

Same loan as Example 1, plus 200/month extra principal.

Inputs

- Base P&I payment M ≈ 2,216.58

- Extra principal = 200.00/month

Steps

- First-month interest = 360,000 × 0.0625 / 12 = 1,875.00

- Base principal in month 1 = 2,216.58 − 1,875.00 = 341.58

- Principal paid in month 1 with extra = 341.58 + 200.00 = 541.58

- New balance after month 1 = 360,000 − 541.58 = 359,458.42

- Long-run effect:

- Consistent extra principal reduces balance faster → less future interest → earlier payoff.

- With +200/month, the payoff is about 288 months (~24 years) instead of 360.

- Interest saved is about 102,222.33 (vs paying only M).

Result

- Monthly cash to P&I = 2,216.58 + 200.00 = 2,416.58

- Approx payoff time ≈ 24 years

- Approx interest saved ≈ 102,222.33

Sanity check

- Extra paid over 288 months = 200 × 288 = 57,600

- Interest saved can exceed “extra paid” because you eliminate many later payments.

Example 3 (comparison): 30-year vs 15-year

Compare the same principal P = 360,000:

- Option A: 30-year at 6.25% (n = 360)

- Option B: 15-year at 5.75% (n = 180)

Steps and results

- Option A monthly P&I:

- M_30 ≈ 2,216.58

- Total interest ≈ (2,216.58 × 360) − 360,000 = 437,969.49

- Option B monthly P&I:

- M_15 ≈ 2,989.48

- Total interest ≈ (2,989.48 × 180) − 360,000 = 178,105.74

- Comparison:

- Monthly difference ≈ 2,989.48 − 2,216.58 = 772.90

- Interest savings ≈ 437,969.49 − 178,105.74 = 259,863.75

Sanity check

- The shorter term repays principal faster, so the interest base shrinks quickly—big interest savings are expected.

Mortgage Payments Common mistakes and fixes

- Using home price instead of loan principal → Payment formula uses P (amount borrowed) → Use price − down payment (plus rolled-in costs).

- Using APR in the payment formula → APR includes fees; interest accrues at the note rate → Use note rate for M; use APR for comparing offers.

- Treating annual rate as monthly → Overstates interest by ~12× → r = i/12.

- Wrong number of payments → 30 years = 360 payments → n = years × 12.

- Assuming escrow is fixed → Taxes/insurance can rise → Re-check annually; keep buffer.

- Thinking escrow reduces the balance → Escrow pays third parties → Track balance via amortization.

- Expecting principal portion to be constant → It rises over time as interest falls → Use monthly split formulas.

- Ignoring PMI rules → PMI can be removable → Ask about cancellation conditions and timing.

- Comparing “payment” numbers that aren’t the same definition → Some quotes show P&I only → Ensure you’re comparing P&I vs total consistently.

- Forgetting HOA/condo dues → Not part of P&I → Add separately to housing cost.

- Not checking rounding → Different schedules differ by cents → Small differences are normal.

- Assuming extra money always shortens the term → Some servicers apply it differently → Mark extra as “principal only.”

- Misreading “fixed-rate” changes → Usually escrow/PMI/HOA changed, not P&I → Check the statement breakdown.

- Ignoring first payment timing → Can affect prepaid interest at closing → Review closing disclosure.

Sanity checks and quick shortcuts

- Early-month interest estimate: balance × (annual rate/12).

- If the rate increases, P&I increases; if the term shortens, P&I increases (all else equal).

- If your fixed-rate total payment changed, check escrow/PMI/HOA before assuming the rate changed.

- An extra principal reduces future interest because the balance is smaller next month.

- A meaningful “extra payment” habit: add 1/12 of a payment monthly to mimic one extra payment per year.

- If your first-month principal is small, that’s normal on long terms at moderate/high rates.

- Compare loans by holding principal constant; then evaluate rate/term/fees/PMI.

FAQs

Why are early payments mostly interest?

Interest is calculated on the remaining balance. Early on, the balance is close to the original principal, so balance × monthly rate is large. As the balance drops, interest drops, and more of each payment goes to principal.

What’s the difference between P&I and PITI?

P&I is principal plus interest only. PITI adds property taxes and homeowners’ insurance (usually through escrow). Many budgets also add PMI and HOA, even though those aren’t in the acronym.

Does a lower rate always mean a lower monthly payment?

For the same loan amount and term, a lower note rate lowers P&I, but the total amount you pay monthly might not drop if taxes, insurance, PMI, or HOA fees increase. Points can also change the tradeoff between upfront cost and monthly savings.

Why did my payment go up on a fixed-rate mortgage?

Most commonly, escrow changed because taxes or insurance changed. PMI or HOA can also change. The P&I portion usually stays the same on a true fixed-rate loan paid on schedule.

How do I make sure extra payments go to the principal?

Check your servicer’s payment instructions and your statement. Some require you to specify “apply to principal.” If you don’t, the system may treat it as paying ahead rather than shortening the loan.

What does “amortization” mean?

It’s the process of paying off a loan with fixed payments over time. Each payment includes interest and principal, and the principal portion typically increases as the balance declines.

Is mortgage interest calculated monthly or daily?

Many servicers accrue interest daily and collect it through monthly payments. If you pay on time, the difference from simple monthly-rate math is usually small. Late payments can increase interest because the balance stays higher longer.

How does PMI affect my payment?

PMI is an added monthly cost on many low-down-payment loans. It increases your total monthly outflow but doesn’t reduce your loan balance. It may be removable once you reach certain equity thresholds, depending on the loan.

What’s the difference between the interest rate and APR?

The note rate drives how interest accrues and determines P&I using the amortization formula. APR includes certain fees and is mainly for comparing offers. APR is not always the right input for the payment formula.

Should I choose a 15-year or 30-year mortgage?

A 15-year loan typically has a higher monthly payment but much lower total interest and a faster payoff. A 30-year loan has a lower required payment and more flexibility, but usually higher total interest. Some borrowers choose a 30-year term and pay extra principal to reduce interest while keeping flexibility.

What happens to payments on an ARM?

When the rate resets, the payment is recalculated based on the new rate, remaining balance, and remaining term. Caps may limit how much the rate/payment can change at each adjustment, but increases can still be meaningful.

How can I quickly sanity-check a quoted payment?

Estimate the first-month interest as balance × (annual rate/12). If that interest is close to the quoted P&I payment, you’ll have slow principal payoff early (normal on long terms). If the quote is far higher or lower, re-check the rate conversion, term, and whether the number includes escrow/PMI.

Mortgage Payments Quick reference

| If you need… | Do this… | Watch out for… |

|---|---|---|

| Monthly P&I | Use M = P * [ r(1+r)^n ] / [ (1+r)^n − 1 ] | Use note rate; r = i/12 |

| This month’s interest | Interest = balance × r | Balance changes monthly |

| This month’s principal | Principal = M − Interest | Early principal can be small |

| All-in monthly budget | P&I + taxes + insurance + PMI + HOA | Escrow/HOA can change |

| Effect of extra payments | Add extra to principal; track payoff | Confirm principal-only application |

| Compare loan options | Hold P constant; compare payment + total interest | Fees/points/PMI can flip the best option |

A fixed-rate mortgage payment is built from an amortization formula that spreads repayment over a set number of monthly payments.

Each payment’s interest is the remaining balance times the monthly rate; the remainder reduces the principal.

Total monthly outflow often includes escrowed taxes and insurance, so it can change even when P&I is fixed.

Early payments feel interest-heavy because the balance is largest at the start.

Extra principal payments reduce future interest by lowering the balance sooner.

APR helps compare offers, including certain fees, but the note rate drives the amortization payment.

PMI increases the monthly cost but does not reduce the loan balance.