Salary conversions are deceptively simple. At a glance, converting an hourly rate to an annual salary looks like basic multiplication. In practice, however, the result depends on assumptions that many people forget to state: hours per week, weeks per year worked, paid vs unpaid time off, and whether you are converting for budgeting, job comparisons, or contract pricing.

This guide provides a practical, repeatable framework to convert pay between hourly, weekly, monthly, and annual amounts—while explicitly accounting for:

- Different weekly schedules (35, 37.5, 40, 45+ hours)

- Unpaid breaks and unpaid time off

- Part-time and variable-hour work

- A “true effective hourly rate” when you have a fixed salary but work extra hours

- Common conversion mistakes that lead to misleading comparisons

The focus clear steps, consistent formulas, and examples you can adapt without needing specialized payroll knowledge. Also, Read – Finance Math Explained: Common Money Formulas With Examples

1) The Key Idea: There Is No Single “Correct” Conversion

A salary conversion is only as accurate as the assumptions behind it. If you see:

- “$25/hour is $52,000/year”

That statement assumes:

- 40 hours/week

- 52 weeks/year

- All hours are paid

- No unpaid time off

- No unpaid breaks

Change any one of those inputs and the annual number changes.

When comparing job offers or planning a budget, you should always ask two questions:

- How many hours are paid?

- How many weeks are paid?

Everything else follows from those.

2) Definitions You Should Use (So Your Conversions Stay Clean)

Before converting, define the terms consistently.

Hourly rate

The amount paid per paid hour (not necessarily per hour on-site).

Hours per week (paid vs worked)

- Paid hours/week: the hours you’re compensated for

- Worked hours/week: the total hours you must be present or actively working

These can differ if you have unpaid breaks or unpaid on-site time.

Weeks per year (paid vs worked)

- Paid weeks/year: weeks you are paid (including paid leave, if any)

- Worked weeks/year: weeks you actually work

If you get unpaid time off, paid weeks/year is lower than 52.

Monthly conversion note

A month is not “4 weeks.” A year has 52 weeks, and 52/12 ≈ 4.333 weeks per month. Using “4 weeks per month” often underestimates monthly pay.

3) Core Conversion Formulas (Reusable)

A) Hourly → Weekly

Weekly_pay = Hourly_rate * Paid_hours_per_week

B) Weekly → Annual

Annual_pay = Weekly_pay * Paid_weeks_per_year

Combine A and B:

Annual_pay = Hourly_rate * Paid_hours_per_week * Paid_weeks_per_year

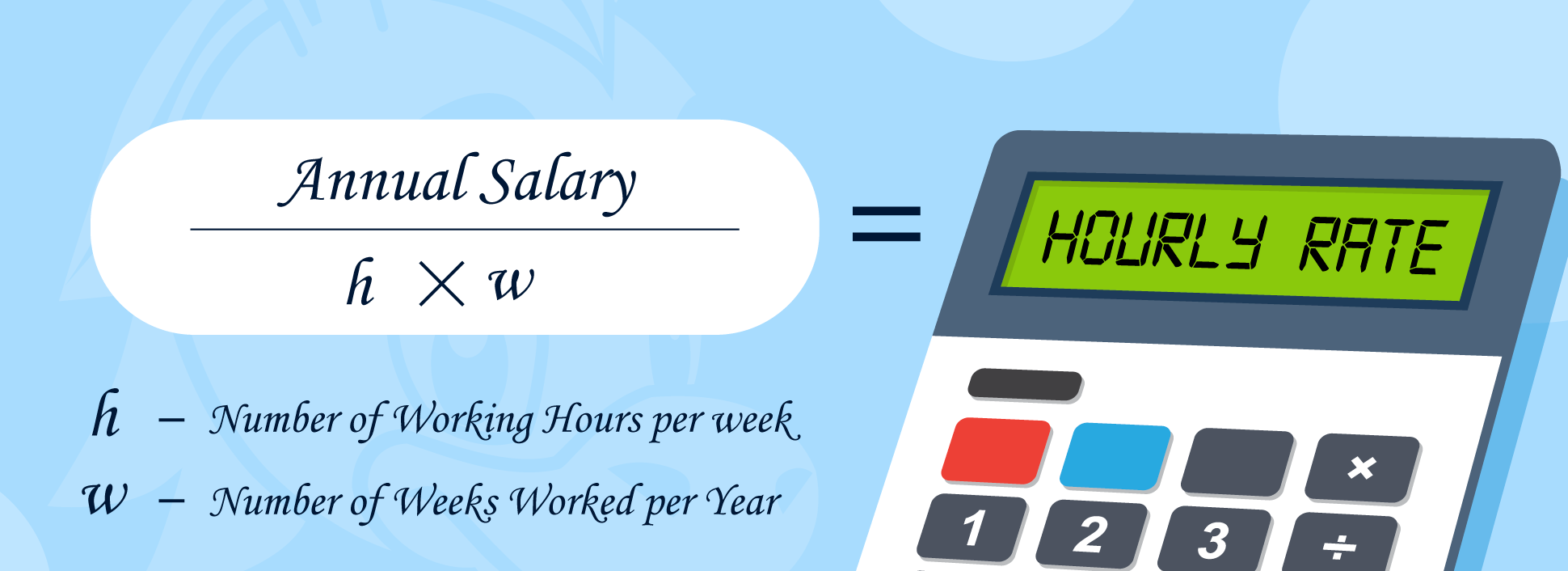

C) Annual → Hourly (effective)

Effective_hourly = Annual_pay / (Paid_hours_per_week * Paid_weeks_per_year)

D) Annual → Monthly

Two common approaches:

Approach 1: divide by 12 (typical for budgeting)

Monthly_pay = Annual_pay / 12

Approach 2: weekly-based (useful if you think in weeks)

Monthly_pay = Weekly_pay * (52 / 12)

These should match if Annual_pay = Weekly_pay * 52 and Paid_weeks_per_year = 52.

4) The Critical Adjustment: Unpaid Time (Breaks and Time Off)

Many people focus on hourly rates but ignore unpaid time, which can materially change the real earning rate.

There are two main categories:

- Unpaid breaks inside a workday (e.g., unpaid lunch)

- Unpaid time off during the year (e.g., unpaid vacation weeks, unpaid holidays)

You can handle these cleanly by converting everything into paid hours and paid weeks.

A) Unpaid breaks (daily)

If you are on-site for 8 hours but have a 30-minute unpaid break, your paid hours may be 7.5.

Example:

- On-site hours/day = 8

- Unpaid break/day = 0.5

- Paid hours/day = 7.5

If you work 5 days/week:

Paid_hours_per_week = 7.5 * 5 = 37.5

B) Unpaid time off (yearly)

If you take 3 weeks off unpaid:

Paid_weeks_per_year = 52 - 3 = 49

5) Common “Standard” Hours and Their Annual Multipliers

Assuming 52 paid weeks per year:

| Paid Hours/Week | Annual Paid Hours (Hours/Week × 52) |

|---|---|

| 20 | 1,040 |

| 25 | 1,300 |

| 30 | 1,560 |

| 35 | 1,820 |

| 37.5 | 1,950 |

| 40 | 2,080 |

| 45 | 2,340 |

| 50 | 2,600 |

Why this matters: If you hear “2,080 hours per year,” that assumes 40 paid hours/week and 52 weeks/year. If you are paid 37.5 hours/week, the annual paid hours are 1,950—not 2,080. Also, Read – Inflation Explained: Real Value Over Time (With Practical Examples)

6) Example 1: Hourly to Annual (Straightforward Full-Time)

Scenario:

Hourly rate = 28

Paid hours/week = 40

Paid weeks/year = 52

Annual_pay = 28 * 40 * 52

Annual_pay = 28 * 2,080

Annual_pay = 58,240

If you want monthly:

Monthly_pay = 58,240 / 12 ≈ 4,853.33

If you want weekly:

Weekly_pay = 28 * 40 = 1,120

7) Example 2: Hourly to Annual With Unpaid Lunch (Common Case)

Scenario:

Hourly rate = 28

On-site schedule = 8 hours/day, 5 days/week

Unpaid lunch = 0.5 hours/day

Paid weeks/year = 52

Paid hours/day:

Paid_hours_per_day = 8 - 0.5 = 7.5

Paid hours/week:

Paid_hours_per_week = 7.5 * 5 = 37.5

Annual pay:

Annual_pay = 28 * 37.5 * 52

Annual_pay = 28 * 1,950

Annual_pay = 54,600

Comparison to “40 hours/week” assumption:

The difference is:

58,240 - 54,600 = 3,640 per year

That gap often surprises people because the daily unpaid break feels small, but it compounds across the year.

8) Example 3: Hourly to Annual With Unpaid Time Off

Scenario:

Hourly rate = 28

Paid hours/week = 37.5

Unpaid time off = 3 weeks/year

So paid weeks/year = 49

Annual pay:

Annual_pay = 28 * 37.5 * 49

Annual_pay = 28 * 1,837.5

Annual_pay = 51,450

Now compare:

- 37.5 hours/week and 52 weeks = 54,600

- 37.5 hours/week and 49 weeks = 51,450

Unpaid time off reduces annual pay by:

54,600 - 51,450 = 3,150

9) Example 4: Weekly to Annual (When Pay Is Stated Per Week)

Sometimes pay is quoted as a weekly amount, especially for contract roles.

Scenario:

Weekly pay = 1,250

Paid weeks/year = 48 (because there are 4 unpaid weeks)

Annual_pay = 1,250 * 48 = 60,000

Monthly:

Monthly_pay = 60,000 / 12 = 5,000

10) Monthly Conversions: Avoid the “4 Weeks = 1 Month” Mistake

A month is not exactly 4 weeks. If you convert weekly to monthly using 4 weeks, you understate monthly pay.

Correct weeks-per-month:

Weeks_per_month = 52 / 12 ≈ 4.3333

Example

Weekly pay = 1,000

Incorrect monthly estimate:

1,000 * 4 = 4,000

More accurate monthly estimate:

1,000 * 4.3333 ≈ 4,333.33

That difference is:

333.33 per month

Over a year, it becomes exactly 4,000—because “4 weeks/month” implicitly assumes only 48 weeks in a year.

11) Quick Conversion Factors (Useful for Mental Math)

These assume 52 paid weeks/year and are common reference points:

| From | To | Multiply By | Notes |

|---|---|---|---|

| Hourly | Weekly | Paid_hours_per_week | Use paid hours, not on-site hours |

| Hourly | Annual | Paid_hours_per_week * Paid_weeks_per_year | Often 2,080 for 40×52 |

| Weekly | Annual | Paid_weeks_per_year | Typically 52 if paid all year |

| Annual | Monthly | 1/12 | Budgeting-friendly |

| Weekly | Monthly | 52/12 ≈ 4.3333 | More accurate than ×4 |

| Monthly | Annual | 12 | Straightforward |

12) Part-Time Conversions (Where Assumptions Matter Even More)

Part-time roles often vary by week. The right approach is to use average paid hours/week over a representative period.

Example 5: Part-Time With Variable Hours

Assume:

- Hourly rate = 22

- Average paid hours/week = 24

- Paid weeks/year = 50 (2 unpaid weeks)

Annual pay:

Annual_pay = 22 * 24 * 50

Annual_pay = 22 * 1,200

Annual_pay = 26,400

Monthly:

Monthly_pay ≈ 26,400 / 12 = 2,200

13) Salary to Hourly: Finding Your True Effective Hourly Rate

If you are paid a fixed annual salary but regularly work more hours than the “official” schedule, you can estimate your effective hourly rate. Also, Read – Mortgage Payoff Strategies Explained (Extra Payments + Examples)

This is particularly useful when:

- Comparing salaried offers to hourly contract offers

- Negotiating workload expectations

- Understanding whether overtime is effectively unpaid

Example 6: Annual salary, longer workweeks

Assume:

- Annual salary = 75,000

- Paid weeks/year = 52

- Actual worked hours/week = 50 (even if “standard” is 40)

Effective hourly:

Effective_hourly = 75,000 / (50 * 52)

Effective_hourly = 75,000 / 2,600

Effective_hourly ≈ 28.85

Now compare if the person assumed 40 hours/week:

75,000 / (40 * 52) = 75,000 / 2,080 ≈ 36.06

The “headline” hourly equivalent (36.06) is much higher than the true effective rate (28.85) if the workload is consistently 50 hours/week.

14) Including Unpaid Commute or On-Call Time (Optional but Often Revealing)

Some roles require time that is not compensated but is functionally necessary, such as:

- Commute (especially if long and unavoidable)

- On-call time that restricts your freedom

- Mandatory unpaid prep time

These are not always “paid hours,” but they may still matter when comparing roles.

You can compute an “all-in effective hourly” as:

All_in_effective_hourly = Annual_pay / Total_time_committed_per_year

Where total time committed includes worked hours plus required unpaid time.

This is not a payroll calculation; it is a decision-making tool.

15) Example 7: All-In Effective Hourly With Unpaid Commute

Assume:

- Annual pay = 54,600 (from earlier 28/hour, 37.5 paid hours/week, 52 weeks)

- Worked/on-site time is 40 hours/week (because of unpaid lunch)

- Commute is 1 hour/day total (round trip), 5 days/week = 5 hours/week

- Total time committed/week = 45 hours

- Weeks/year = 52

Total time committed/year:

45 * 52 = 2,340 hours

All-in effective hourly:

54,600 / 2,340 ≈ 23.33 per hour

This number can be useful when comparing a lower-paying remote role to a higher-paying on-site role with substantial unpaid time commitments.

16) Unpaid Time Off vs Paid Time Off: How to Model Both

Paid time off (PTO)

If time off is paid, it does not reduce annual pay. It reduces worked weeks but not paid weeks.

- Paid weeks/year may still be effectively 52

- Worked weeks/year is lower (relevant for workload, not payroll conversion)

Unpaid time off

If time off is unpaid, it reduces paid weeks/year directly.

Practical approach:

- For pay conversions: use paid weeks/year

- For lifestyle comparisons: also track worked weeks/year

17) A Simple Worksheet Method (Use This for Any Scenario)

To convert any pay structure, fill in these inputs:

- Hourly rate (if hourly) or annual salary (if salaried)

- Paid hours/week

- Paid weeks/year

- Any unpaid breaks (convert to paid hours/week)

- Any unpaid time off (convert to paid weeks/year)

Then compute:

Annual_pay = Hourly_rate * Paid_hours_per_week * Paid_weeks_per_year

Monthly_pay = Annual_pay / 12

Weekly_pay = Annual_pay / Paid_weeks_per_year

If starting from annual salary:

Effective_hourly = Annual_pay / (Paid_hours_per_week * Paid_weeks_per_year)

18) Common Mistakes and How to Avoid Them

Mistake 1: Assuming 40 paid hours/week

Many roles are 37.5 paid hours/week due to unpaid lunch. Always confirm paid hours.

Mistake 2: Assuming 52 paid weeks/year

Contract roles and hourly roles may have unpaid gaps. Use paid weeks, not calendar weeks.

Mistake 3: Using “4 weeks per month”

This implicitly assumes 48 weeks/year. Use 52/12 ≈ 4.3333 weeks/month.

Mistake 4: Comparing salary to hourly without adjusting for actual hours worked

If a role routinely requires extra hours without additional compensation, the effective hourly rate can be materially lower.

Mistake 5: Ignoring unpaid time that is functionally required

Commute and on-call constraints can change the practical value of a job offer even if the payroll conversion looks good.

19) Quick Reference Examples (At a Glance)

Hourly to annual multipliers

If paid weeks/year = 52:

- 20 hours/week → multiplier = 1,040

- 37.5 hours/week → multiplier = 1,950

- 40 hours/week → multiplier = 2,080

- 45 hours/week → multiplier = 2,340

So:

Annual_pay = Hourly_rate * multiplier

Example: 30/hour at 37.5 paid hours/week:

30 * 1,950 = 58,500

Weekly to monthly

Monthly_pay ≈ Weekly_pay * 4.3333

Example: 1,200/week:

1,200 * 4.3333 ≈ 5,200

FAQs

1) How do I convert an hourly rate to annual pay?

Use:

Annual_pay = Hourly_rate * Paid_hours_per_week * Paid_weeks_per_year

The key is that the hours and weeks should reflect what is actually paid.

2) What’s the fastest “standard” full-time conversion?

A common full-time assumption is 40 hours/week and 52 weeks/year:

Annual_pay = Hourly_rate * 2,080

But confirm whether you truly have 40 paid hours/week.

3) How do unpaid lunch breaks affect salary conversions?

If lunch is unpaid, reduce paid hours/week accordingly. For example, 30 minutes unpaid per day across 5 days reduces paid hours by 2.5 hours per week (40 → 37.5).

4) Why is dividing monthly pay by 4 misleading?

Because months average about 4.333 weeks. Dividing by 4 assumes only 48 weeks in a year.

5) How do I handle unpaid time off?

Reduce paid weeks/year:

Paid_weeks_per_year = 52 - Unpaid_weeks_off

6) How do I convert annual salary to an hourly rate?

Use:

Effective_hourly = Annual_pay / (Paid_hours_per_week * Paid_weeks_per_year)

If you regularly work extra hours, use actual worked hours/week to estimate a more realistic effective rate.

7) What is the difference between paid hours and worked hours?

Paid hours are compensated. Worked hours may include unpaid breaks, commute, or other required time. For payroll conversions, use paid hours; for job comparisons, consider both.

8) How do I compare two offers fairly if one is hourly and one is salary?

Convert both to annual pay using realistic assumptions about paid hours/weeks. Then compute effective hourly rates using expected worked hours/week, not just “official” schedules.

9) How do I convert weekly pay to annual pay?

Use:

Annual_pay = Weekly_pay * Paid_weeks_per_year

10) What assumptions should I always state?

At minimum:

- Paid hours per week

- Paid weeks per year

- Whether breaks are paid

- Whether time off is paid or unpaid